Small businesses are one of the most susceptible to business frauds. And at the same time these businesses employ individuals they fully trust and they cannot preclude unpredictable behavior- even it’s from their most reliable partners. Fraud affects 1 in 4 small business every year- with SMEs losing an estimated $25.6 million in a few years back. Therefore, it is necessary to understand that small business fraud can impact your small business and you need to be alert to face it or take some preventive measures.

Small businesses have a misconception that fraud cannot happen to them it is only possible in large firms. Whereas the reality is, small businesses don’t have more than 25-30 employees in their firm on whom they trust blindly as they have been dedicatedly working for the company for so many years. These employees do the most vulnerable fraud to the organization.

As per the report of Association of Certified Fraud Examiners (ACFE), estimated average losses for small organizations that fell victim to fraud were $150,000 in 2016. Let me share one more frightening stats with you, it is estimated that a small business is expected to lose 6% of its revenue to fraud.

Now let me pause you with the math in your head! Watch these red flags to detect fraud in your business:

- Open access leads to more risk-

Being a small business owner, give no single employee to access payments and track business expenses. Keep a financial control on your books and monitor financial-related matters precisely. If you give too much financial control to even one employee, your company is already at more risk of being trapped in financial fraud.

However, if an employee is assigned to perform accounting duties that doesn’t mean they have mala fide your books.

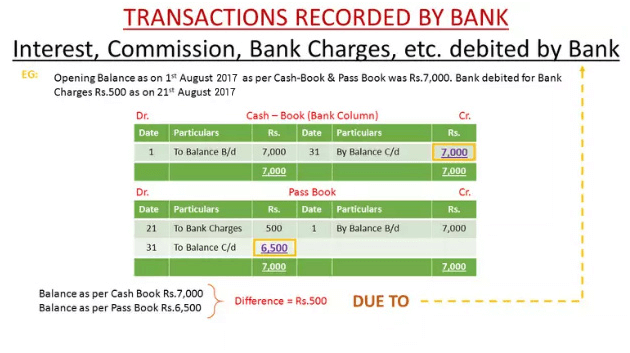

- Discrepancies in cash balance-

If you are using the cash register for your business to record daily transactions, or deposit checks or receive funds by electronic means, there can be higher chances of errors against your income and expenses. Moreover, sometimes even bank deduct some charges or interests that you might be not aware of.

If you find a lot of highs and lows in your cash register this is a sign of skimming. As high balances may be a signal that an employee is trying to make up for a past fraud and low balance may indicate for any future fraud.

- Not giving a chance to another employee for managing tasks-

If an in-house employee wants to do everything themselves and never takes leaves who may be a type A is also a sign of fraud. As they might be trying to hide a fraud.

And they know, if you hire a bookkeeper he can easily detect fraud while reconciling the statement, so they don’t want anyone to take over their work.

- Scams by vendor and suppliers-

Not every stab at fraud come from an in-house employee. Unluckily, some come from defrauders claiming to be potential suppliers or lenders, providing a helpful service or a quick loan before taking cheating you and becoming dissolvent.

Be cautious of any unwanted offers from businesses that ask you to pay first and claims to increase your business contact or reputation, which every small business desires. However, some offers may not ask you to pay, but instead are phishing cons that just want you to click on an infected link to gather all your financial information.

- Large number of transactions-

If there are multiple payments on single bills or you find frequent transactions to correct errors may indicate some kind of fraud. Your employee may be trying to camouflage payments to themselves, conceal a fraudulent transaction in paperwork or cover up a previous fraudulent transaction.

How you stop these fraudulent activities before losses increases? Here are 5 best strategies that can help you spot and stop small business frauds:

- Implement anti-fraud controls-

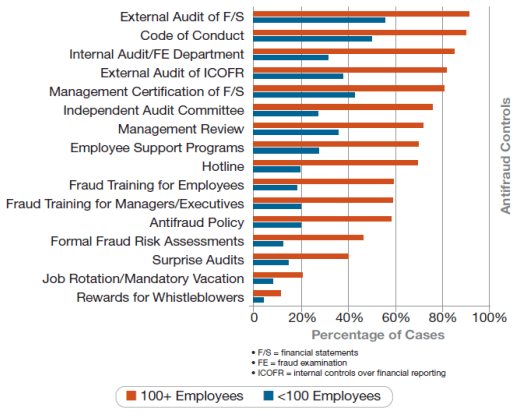

For small businesses, implementing anti-fraud controls is a costly affair and complex. But according to the 2012 Report to the Nations on Occupational Fraud and Abuse by the Association of Certified Fraud Examiners (ACFE).

However, small businesses if invest in anti-fraud controls it does pay off. Companies with these kinds of precautions reported losses up to 54% smaller than those without them. And these precautions also resulted in fraud being detected 33% to 50% more quickly than in companies without them, the report said.

- Look into the business “fraud-triangle” –

There three consistent factors, which can lead an employee to compel business fraud:

- Financial difficulties in employees personal life

- A seeming opportunity

- Rationalization

However, the third point of the fraud triangle is the sneakiest of all. Employees may firstly tell themselves they are poorly paid or simply “borrow” small amounts of money and promise to reimburse in due time, only to become win the trust and once their action is overlooked you see the real face. If you find such employees catch-hold them immediately.

- Keep a hawk-eye on the bottom line-

According to ACFE reports, small business frauds are usually brought in light by their managers. As soon as the managers review their work reports including account reconciliation, analyzing financial reports, or any other financial irregularities they can spot fraud. So small businesses should keep a hawk on their financial statements and should have basic knowledge of accounting. Or else you can move outsourced accounting service provider to reconcile your statements and give you an exact picture of your finances.

- Watch for early signs

For many employees doing fraud is a regular job, and the numerous fraudulent employees are first-time offenders. While most employee never involves in such activities, small business owners know their employees well and they may find it easier to detect changes in behavior that permit closer consideration.

However, as per the ACFE report, nearly 80% of employee fraud says that warning signs were clearly present.

So watch for:

- Financial difficulties in an employee’s life

- Recent divorce or other family issues

- Noticeable consumption or living a life beyond their revenues

- A “wheeling and dealing” attitude

- Excessive control issues

- Don’t blindly trust your employees-

Small businesses usually prefer to hire their closed ones or may trust their initial employees blindly that increases more prospects for fraud. That’s why it is often hard to believe when you find potential employee’s fraud. Executing reliable controls and policies are some effective ways of protecting against without hurting the trust at the center of your company’s culture.

Bottom line

Small business should train their workforce to notice any fraudulent activity in the business and establish an internal system of checks to keep everyone truthful. In this way, you can reduce your susceptibility to fraud and give your business its best to thrive in the market.

Alika Cooper is a Business Development Manager at Cogneesol, a well-renowned company offering data management, technology, legal and accounting services. She has been working with Cogneesol for the past 10 years and is responsible for branding and generating sales. While handling the projects, she has witnessed a lot of changes over the years. She has been thoroughly researching and sharing her viewpoints about these industry trends and changes on many platforms across the Internet.